Foreclosure Alley

© Lauren GreenfieldAfter several years of prosperous growth and a major housing boom, the Inland Empire has become emblematic of the recent economic crisis, giving it the name “Foreclosure Alley”. The area owes its high concentration of economic distress to its birth as a logical commuter convenience: ten years ago, new real estate and loose financing lured families who work in Los Angeles and San Diego to invest in the exurb communities.

Banks facilitated the surge with generous loans, and families built expensive backyards for their children and new cars for their gas-consuming commutes. Buoyed by fiscal optimism and a pursuit of the American Dream, people refinanced their homes and spent hundreds of thousands of dollars on pools, spas, tiki bars and fire pits. Lake Elsinore, a city in the Inland Empire, launched its urban identity campaign with the exhortation, “Dream Extreme”, a slogan that didn’t anticipate the effects of variable-rate mortgages, falling property values, and rising gas prices. Between 2004 and 2007, over 360, 000 homes were purchased. By November 2008, virtually all are worth less than what is still owed on them, and over a third have defaulted.

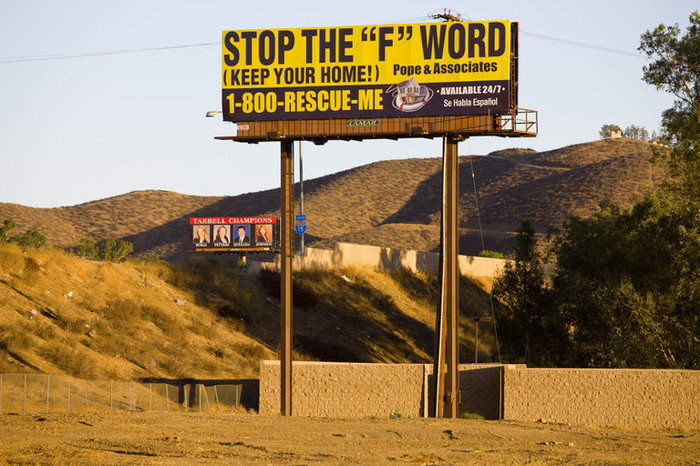

The landscape of the Inland Empire is a battlefield of empty homes and ghosts of the American Dream. Local signs offer tours of foreclosed homes and aid: “Stop the F-Word! 1-800-RESCUE-ME.” Residential streets are lined with “bank owned” signs, and foreclosure notices dot windows. The epidemic has yielded some odd industries: laid-off real estate agents have turned to businesses that “trash out” foreclosed homes. Some people abandon a full furnishing of goods: large TVs, leather sofas, family photos, 401k statements, and even an urn. Other industrious workers freshen dead lawns with green spray paint, while code enforcement officers drain abandoned pools. As one says, “You know something is wrong when the lawns are brown and the pools, green.”

click to view the complete set in the archive